FTA's Board approves procedure for refunding VAT on building new homes for UAE citizens

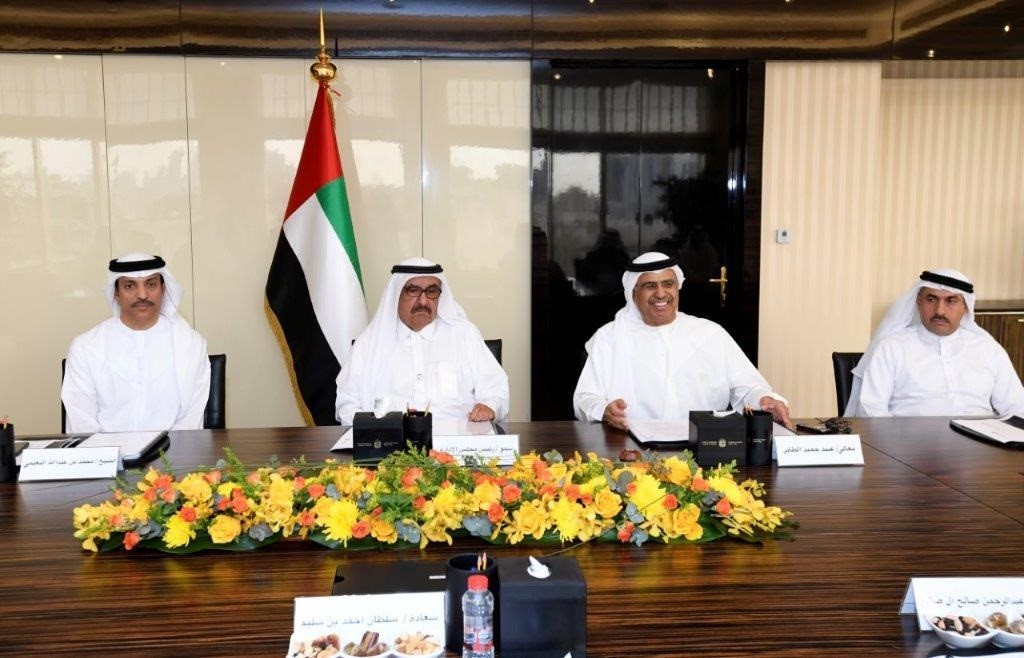

The Board of Directors of the Federal Tax Authority, FTA, held its 10th meeting today at the FTA’s Dubai headquarters, headed by its Chairman H.H. Sheikh Hamdan bin Rashid Al Maktoum, Deputy Ruler of Dubai, UAE Minister of Finance, where it presented a report on the FTA’s recent activities and accomplishments.

The report pointed to a significant increase in tax compliance rates in the UAE, where the number of Taxable Persons registered with the Authority exceeded 311,400 individuals, organisations, and tax groups. Records show that 754 businesses are now registered for Excise Tax, while the number of authorised Tax Agents reached 305.

The Board adopted a new procedure to facilitate refund requests for UAE nationals on the Value Added Tax, VAT, incurred on the construction of their new residences, in line with the leadership’s vision to develop a modern housing system, spread happiness among citizens, and provide a decent, stable life for them. In coordination with housing finance authorities, the FTA will minimise auditing requirements on applications approved by these authorities.

The Federal Tax Authority implements tax legislation that reflect the UAE Government’s commitment to ensure the wellbeing of its citizens. To that end, clear and transparent standards and procedures were set to facilitate the process of recovering VAT incurred on building new residences by Emirati nationals. The Authority streamlined and expedited tax refund procedures on its website for those who are legally eligible. This forms part of the UAE’s efforts to provide a high quality of life for its citizens, who are consistently placed at the core of all development plans, projects, and initiatives carried out by various institutions in the Emirates.